Are you looking for ways to improve your financial management? Running a business is no mean feat and has recently been made harder with issues surrounding the global pandemic, supply chain delays and Brexit. If you’re looking for helpful techniques to tighten your belt or tidy up messy finances, then here are some top tips:

- Be aware of your annual budget

Having a good knowledge of your annual budget is vital in terms of financial management for the year. A budget is a helpful guide for knowing what you can spend, if you can expand and to enable you to make strong business decisions throughout the year. Take some time to analyse your expenditure and income so you can make your money work harder for you. Seek advice from Gloucester accountants and visit Gloucester accountants Randall and Payne

- Go digital

Get rid of the reams of paper balances and receipts that take up space and are time-consuming to go through. By doing things digitally, you’ll have everything in one place, easily accessible and that can be backed up so you never lose any vital information. Invoicing and accounting can be done this way and it’s much more efficient as you’re streamlining your business processes.

- Join up with the right investors

Investors are essential as they help you to gain more funds than you could through loans, for example. They can also provide invaluable assistance in keeping the business afloat in tough times. Do some research and find out what recent investments they have made and how involved they wish to be before making any decisions.

- Get into the habit of financial forecasting

Looking at market trends and getting into the habit of forecasting for the year ahead will put you in a much stronger position for the financial year. This also provides a far better understanding of where your company is and where it might be in the future.

- Taking care of debt

It’s not ideal for a business to carry over debt from the previous financial year into the next. Before considering loans to cover debt, try to come up with a well planned strategy for dealing with debt. Outstanding payments should be taken care of quickly and efficiently before the next financial year begins.

- Keep a good credit score

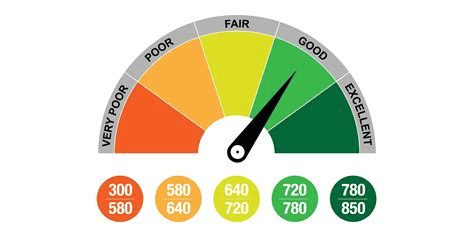

A credit score is used to determine how credit worthy a business is, so you’ll want to ensure you keep yours in a healthy position. A good credit score can improve the financial position of a business as well as act as a sign of trust and goodwill. If a business has a low score, the priority should be working to improve it before making any other important decisions.

- Protect against fraud

Cyber security is a major concern for modern businesses. Tightening up your financial management now includes taking steps to protect your information, data and assets from an online attack. Firewalls and antivirus updates are the minimum to protect your business and the information of your customers and clients.